Making and Tracking Gifts

-

6.1 Make gifts to organizations you selected

Once you have selected organizations, the next step is to decide how you would like to allocate your philanthropic budget. Look back at Activity L to recall how much of your budget you allocated to each focus area.

You may also consider volunteering with the organizations you have selected, including serving on an organization’s board, in order to gain firsthand experience within your focus area and further support the organizations’ work. Your primary consideration should be whether your expertise and other talents can help the organization achieve its goals. (Don’t join a board in order to direct or track how your gifts are used.) Refer back to Section 1.3 and Activity F for more considerations regarding volunteering and board service.

Once you have decided which organizations to fund and for what lengths of time, this section will help you build a funding plan for your focus areas.

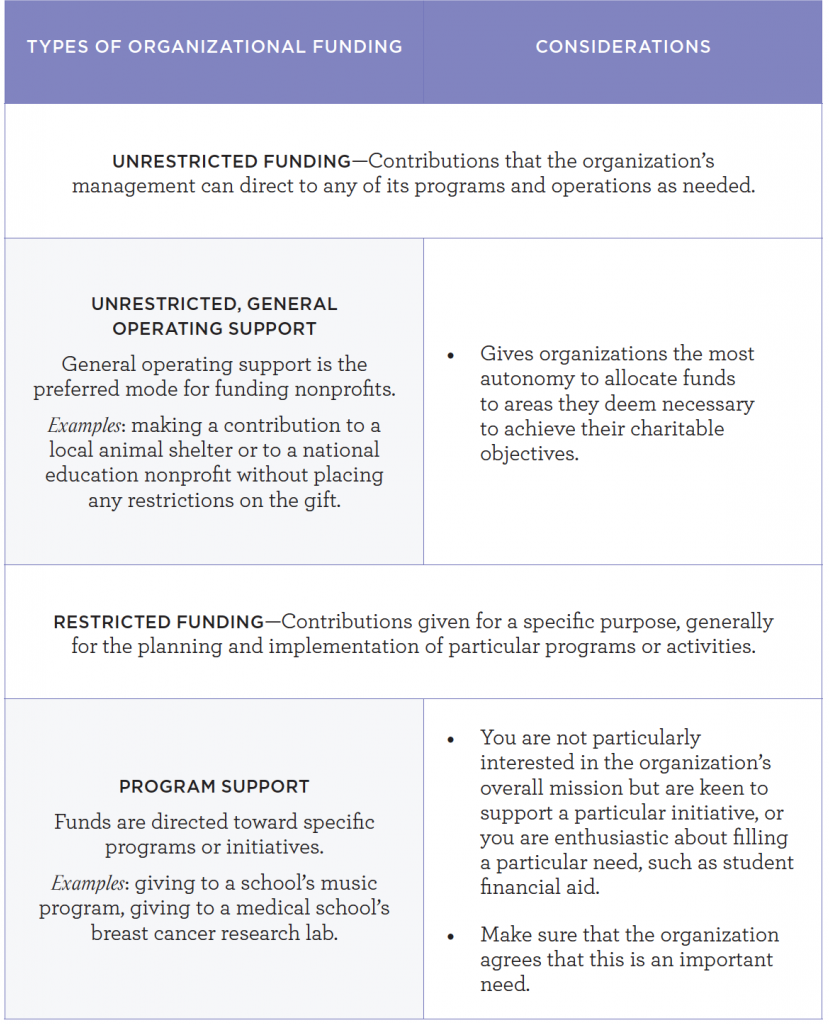

Types of organizational funding

When you make a financial gift to a nonprofit organization, you can designate it as either unrestricted or restricted funding. In keeping with best practices in philanthropy, we recommend that you mainly provide unrestricted general operating support. After all, the basic purpose of the due diligence process was to identify effective organizations whose leadership could be trusted to decide how best to allocate resources toward your shared stated goals.

Nonetheless, you may sometimes make a gift designated for a particular project that you and the organization’s leadership agree is particularly important. If so, be sure that part of the gift covers indirect costs, or overhead—to cover the gift’s share of the organization’s administrative expenses including office space, phone bills, and back office staff. We recommend that at least 15%–20% of the gift be put toward these essential indirect costs.

TYPES OF ORGANIZATIONAL FUNDING

When making a gift of significant size—either in terms of the organization’s budget or your own resources—consider whether and under what circumstances you wish to make it a multi-year pledge. Longer-term pledges, which can be binding or not, help an organization engage in strategic planning for the future.

While the typical gift is expendable and can be used to meet the organization’s current needs, some organizations seek gifts to endowment funds—for example, for scholarships or professorships at a college. Endowment funds are invested in perpetuity, and the organization uses the income to pay for current needs.

Determine the frequency and time frame of your gift

When making a gift of significant size—either in terms of the organization’s budget or your own resources—consider whether and under what circumstances you wish to make it a multi-year pledge. Longer-term pledges, which can be binding or not, help an organization engage in strategic planning for the future.

While the typical gift is expendable and can be used to meet the organization’s current needs, some organizations seek gifts to endowment funds—for example, for scholarships or professorships at a college. Endowment funds are invested in perpetuity, and the organization uses the income to pay for current needs.

Record your gift

It is important to develop a system for recording your gifts. This will allow you to step back and reflect on your overall philanthropic portfolio. Use whatever format is convenient for you, such as a notebook, spreadsheet, or database. For tax purposes, unless you are giving through a DAF (with which you’ve already received a tax deduction when you put funds into the account), make sure that the organization provides you with a written receipt listing the date and amount or description of the contribution.

-

6.2 Track your philanthropy

The philanthropic process does not end once your gifts are made. The next few paragraphs will help you track and learn from your giving and increase your effectiveness.

Understanding impact in your philanthropy

Donors sometimes wish to trace the use of their every dollar. This reflects a misunderstanding of impact in philanthropy, which is reflected in the overall impact of the organizations you support. Of course, organizations should track and publish their activities, outputs, and outcomes. But tracking each individual gift, even if it were possible, would divert the organization’s resources away from its core mission toward making each donor feel uniquely valuable.

If your due diligence process (per Section 5) gave you confidence in an organization’s effectiveness, every dollar you contribute will add that much more to its outcomes. On the (hopefully rare) occasions when you designate a gift for a particular project, you may be more interested in the results of that project than in the organization as a whole. But as long as you have included adequate overhead funding, you can be confident that your gift did not detract from the organization’s overall effectiveness.

Keep up with organizations you support

Below are some ways to stay current on the organizations you support:

- Read the organizations’ annual reports, which typically include their budgets, accomplishments, and plans.

- Follow the organizations you support on social media platforms (e.g., Facebook, LinkedIn).

- Read the “news” section on the websites of organizations you support and of similar organizations, or sign up for their e-newsletters.

- Attend events hosted by the organizations you support.

- If you made a major gift—for example, a gift that constitutes a noticeable portion of the organization’s budget—consider meeting with the organization to get updates directly from its senior staff.

ACTIVITY P: REFLECT ON YOUR CONTRIBUTIONS OF TIME AND TALENT

Review the questions in Activity P to reflect on the time and effort you have contributed to organizations over your past giving cycle. Also consider your responses about your time and talent in Activity F. Jot down your thoughts.

Suggested printing instructions: Legal-size, landscape, single-sided

Keep up with your focus areas

Beyond tracking your particular contributions, it is useful to stay current about your focus areas. Here are some ways to do this:

- Sign up for e-newsletters from foundations, funders, and thought leaders in your focus areas.

- Explore the websites of prominent foundations and funders who focus on your issues—read their issue-related pages and publications, note their recent grantees, and browse press releases about recent grants.

- Research annual awards that nominate exceptional organizations and individuals working on your focus areas, and learn more about their strategy and approach.

- Talk to knowledgeable peers who support your focus areas.

- Join a peer group or giving circle dedicated to your focus areas or geography (refer back to Section 2: Engaging Others for more information).

-

6.3 Consider expanding or refining your giving

As you continue tracking the organizations you support and develop more confidence in their strategy and impact, you may wish to increase your gifts to further support their work. In addition to increasing annual gifts, consider setting up recurring gifts for a period of years. Such gifts can improve an organization’s stability and financial health. When reviewing your past donated funds, consider which contributions you would like to increase in the upcoming cycle.

Over time, you may decide that you wish to fund new issues or new organizations. This sometimes coincides with parting ways with a current recipient. In this case, we encourage you to help the organization prepare for your transition, especially if your gift constitutes a significant part of its budget, so that its operations do not suffer. At a minimum, most organizations will appreciate notification well in advance of your last gift. You may also consider setting up a transitional gift amount to phase out your support.